Motor insurance software is a specialized tool used by auto insurance companies and agencies to streamline their operations and enhance customer service. These software solutions assist in managing policies, claims, and various other related tasks. By MedinyX auto insurance software, insurers can reduce administrative costs while improving their overall efficiency. With a range of available options in the market, MedinyX software solutions come with varying features and capabilities. Common features include policy administration system, claims processing, customer support, and analytics. By utilizing auto insurance software, companies can enhance their business management and provide a seamless experience to their customers.

Features of MedinyX Auto Insurance Software

Policy Administration System

Policy administration system is a crucial component of auto insurance operations, and auto insurance software offers a dedicated feature to handle this aspect efficiently. With the policy administrative management feature, insurers can effectively create, manage, and track policies throughout their lifecycle.

Underwriting

Underwriting in our auto insurance software plays a significant role in this process. With the help of auto insurance software, underwriters can efficiently assess risk and determine appropriate premiums for policyholders. This feature allows insurers to consider various factors, including driving history, vehicle type, and demographics, in order to make accurate risk assessments.

Claims Administration System

The claims administration system feature offered by auto insurance software allows insurers to effectively handle claims from start to finish. This includes tracking the status of claims, processing them efficiently, and facilitating timely payments to policyholders.

Billing and Payment

Efficient management of billing and payment processes is essential for auto insurance companies, and auto insurance software provides a dedicated feature to handle these tasks seamlessly. This feature enables insurers to effectively manage all aspects of billing and payments, ensuring a smooth financial workflow.

Customer Service

Auto insurance software can help customer service representatives answer questions and resolve issues. This can be done by providing representatives with access to a knowledge base of frequently asked questions, and by allowing them to track the status of claims.

Reporting

Reporting is a vital aspect of auto insurance operations, providing valuable insights into various aspects of the business. With auto insurance software, insurers can easily access and analyze data related to claims. The software can generate reports that provide an overview of claims activity, including the number of claims filed, claims processing time, and claim resolution outcomes.

Customer Relationship Manager (CRM)

Auto insurance software enables insurers to centralize and track customer information in a structured manner. Insurers can capture and store essential customer data, including contact details, policy information, claims history, and communication preferences. By utilizing the CRM feature in auto insurance software, insurers can foster stronger relationships with their customers.

Marketing

By leveraging auto insurance software's marketing feature, insurers can enhance their marketing strategies, reach their target audience more effectively, and generate quality leads. The software's data-driven insights, lead management capabilities, and marketing automation tools enable marketers to optimize their campaigns, build brand awareness, and ultimately drive business growth.

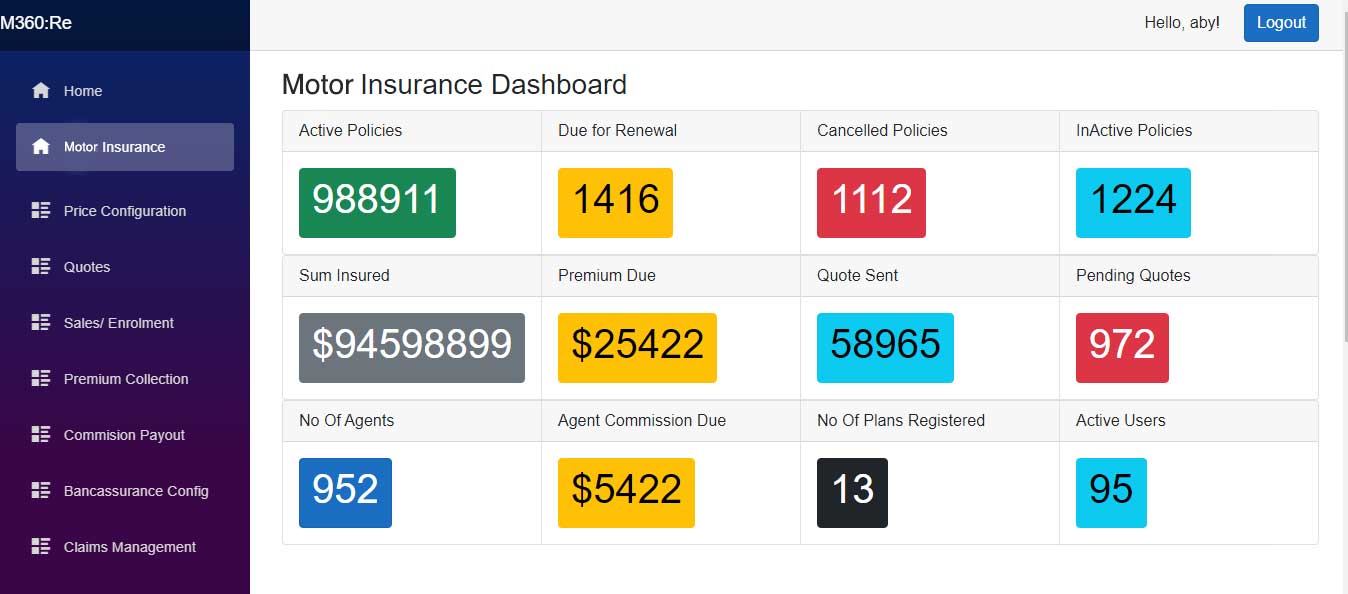

Motor Insurance Backend Admin Platform

Dashboard

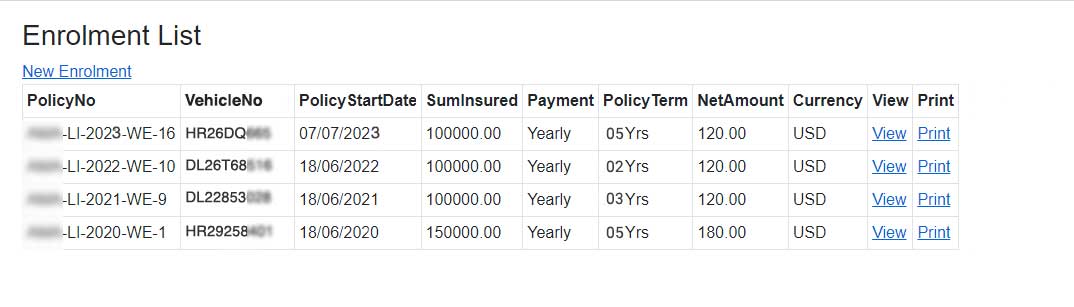

Sales