Digital platforms and devices are sanctioning cheaper, quicker and a lot of scalable solutions that make cover accessible to more of the world's population. Customers can access covers that might antecedently have been unaffordable or inaccessible. Companies can have the benefit of cheaper bundled off-the-shelf solutions.

MedinyX parametric solutions change totally automatic insurance offerings in a lean, cloud-based, modular ecosystem. Features embody real-time reporting, steering, immediate rate indications, automated claim payments and policy administration. Interested partners can simply connect through API's.

- TRAVEL

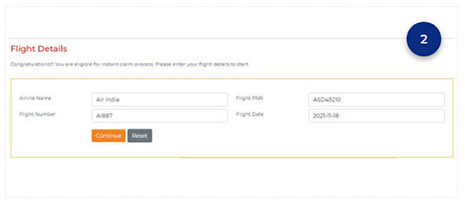

Real-Time Flight Delay & Cancellation Insurance Solutions

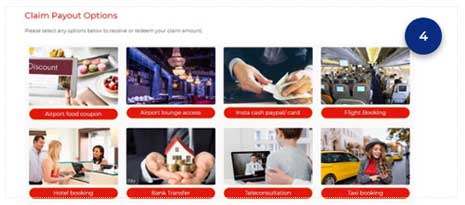

Our parametric flight delay insurance solutions provide insurers and their distribution partners a scalable, easy-to-use platform to make and manage travel insurance covers. The platform allows real-time adjustment of triggers and pay outs, giving our purchasers all the flexibleness and transparency they need to boost performance and steer portfolios.

Claim payments are automatically created once delays are confirmed by a trustworthy third party: The world's leading provider of real-time international flight information, Flight global. Passengers don't need to claim losses. They simply receive the pre-determined pay out upon delayed landing, which may lead to increased customer satisfaction and loyalty.

- TRAVEL

Baggage Delay Parametric Insurance Solutions

Parametric Lost Luggage solution that enables real-time support and the automation of the claims method from the moment the traveler registers their checked baggage as missing, will be delivered by MedinyX.

- FLOOD

Flood Parametric Insurance Solutions

As one of the most frequent and severe natural hazards, flood risk is more and more challenging to insure – pointing to the necessity for parametric flood insurance.

Parametric flood insurance is a solution to raised protect governments, corporate, and communities from flood hazards.

Key Advantage of Parametric Solutions

1. Transparency

Reporting agencies (Independent third parties) provide the information required to trigger payment supported a simple, verifiable and unambiguous method. The simplicity of the payout method substantially reduces claims-related expenses and delays in extraordinary situations.

2. Speed

Rapid recovery with an easy and fast payout process that provides liquidity when you want it most.

3. Bespoke Products

Together with our consultants, parametric solutions are tailor-made for every customer’s individual exposure, risk appetency and legal environment.

4. Elimination of Coverage Gaps

Previously uninsured risks in tourism, trade, renewable energy, agriculture, finance and alternative sectors, supported the bespoke needs of the client, now currently lined. Expenses for items like first-response programmes, evacuation, loss mitigation or clean-up costs, that are usually not covered or are sub-limited, can currently be included.